This article provides a comprehensive understanding of the criteria that include in the list of benefits of Pay for Tax and Cost of Living in certain countries.

Have you heard of the tax news that is being distributed to households across different countries based on the earnings definition of the user? Do you know the process is?

The people of New Zealand, Australia as well as Australia, New Zealand, United Kingdom, and the United States are content to know that there is no division regarding people who do not have a job may be considered the same for those with jobs subject to a set of conditions. Find out how to apply for the Tax on Payments Cost of Living.

How does the tax credit work??

The law that provides benefits through the state to its customers could have fulfilled the hopes of families who live below the line of the average. There are also specific calls for opportunities to work in this law to improve the responsibility of society and increase its income ratio. In this particular direction those who are employed by the government can directly apply for employment.

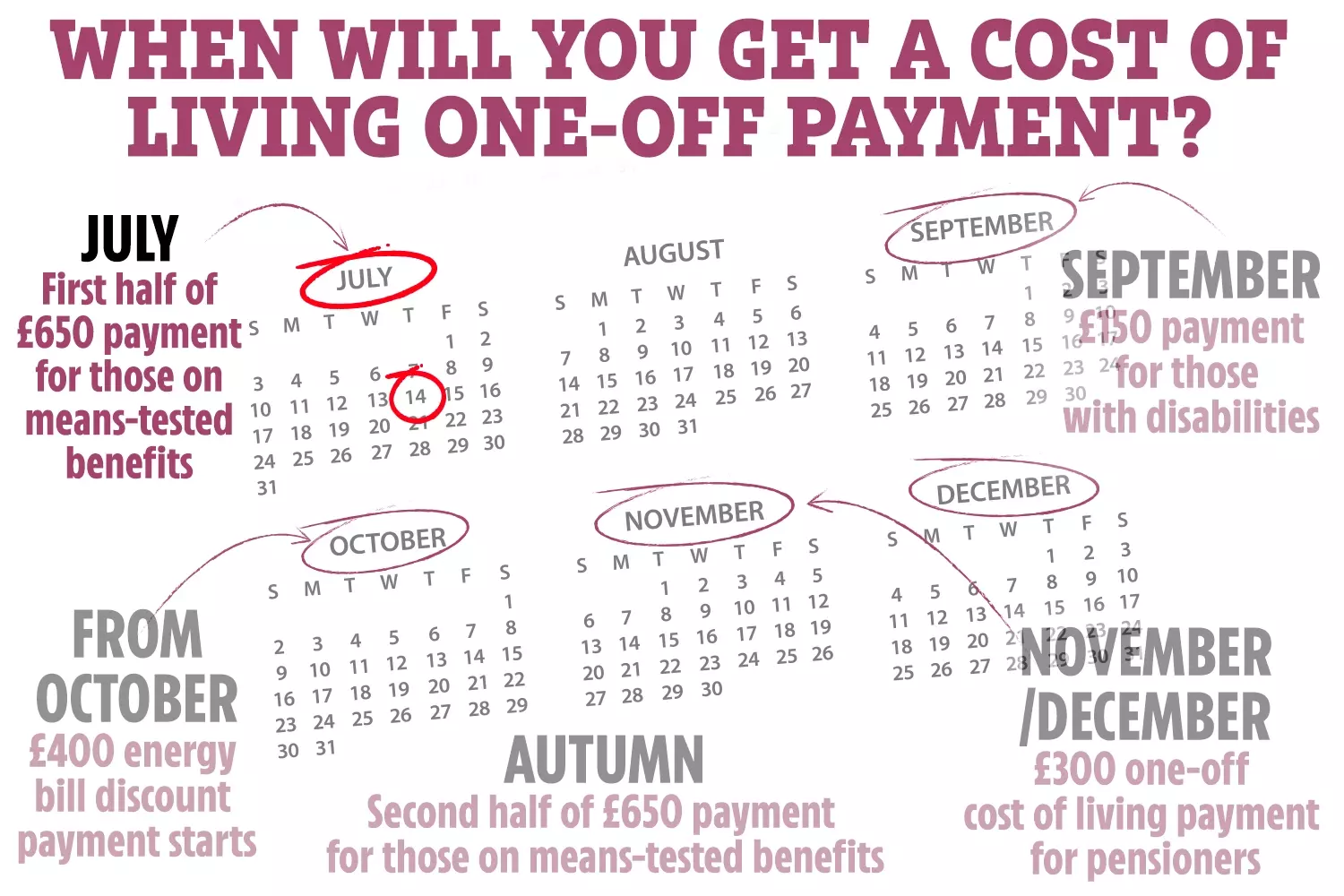

The program was launched on the 26th of April, 2022. Actually, the credit for pensions were added to accounts on the 25th July 2022. Based on the list of banks, one could obtain budgeted handles as well as expenses. Learn more about Cost Living Tax Credits and learn about the requirements to be eligible for the tax credit to qualify!

How do I apply

In 2022, all paid users received a total of euros 326 and the cost of disability is 150. To be eligible for the amount listed in the banks families, they must show the following documents The following documents must be presented:

- People and those who want to get the chance can be eligible to apply even if they aren’t on the new Style Employment and Support Allowance, or the the list of Contributory Employment.

- The applicant must provide the necessary documents for non-universal credit and request a fresh file to accept euro.

The Payment Tax and cost of living

- Users will receive the money listed to their accounts based on their age as well as family members and their monthly income.

- Euro 625 payment is due in two installments to those who have filed Universal Credit, income-based Jobseeker’s Allowance and employment and Assistance Allowance (EAA), Income Support and the Pension Credit.

- In the initial installment, the user must submit a zero award Child Tax Credit and the Working Tax Credit.

- In the next installment, the clients show up at the bank to pay the pension credit using 26 euros of credits on the accounts.

- For disabledpeople, euros 800 and 750 are the most appropriate.

What is the reason why it that the cost of living Payment Update trending?

The news is trending , as different policies are differentiated according to the country of origin for all citizens! More than 30 percent of the users have received their payment in their bank. This has enticed more customers to sign up.

Final Verdict

Based on online research This news article provided information on the guide for citizens and details about the bank to be eligible for the benefits of the living tax. Certain customers required to meet the criteria for getting the tax deductions for residence fees Some are getting on the security bills from the government.

Was the process for getting the Payment for Tax Cost of Living at the Bank easy? Write your comments to gain the same benefits in your country.